These pages are now at www.Theletfreedomringamendment.com

Freedom Mortgage and the Legacy of Inequality in American Home Lending

1. Introduction — When the System Fails Those Who Served

Freedom Mortgage Corporation’s $113 million settlement with the U.S. Department of Justice for violations of the False Claims Act underscores long-standing systemic issues in the U.S. mortgage industry — issues that continue to disproportionately harm non-white borrowers.

While this 2016 case focused on faulty FHA-insured lending practices, the broader story is about inequities that persist across generations of homeowners and veterans. These inequities are not accidents of history; they stem from structural imbalances in access, accountability, and oversight.

2. The DOJ Case: $113 Million Settlement

In April 2016, the U.S. Department of Justice announced that Freedom Mortgage Corporation agreed to pay $113 million to resolve allegations it violated the False Claims Act by knowingly originating and underwriting FHA-insured loans that did not meet program requirements. The company admitted to failing to properly review, report, and self-correct quality-control issues.

“It is imperative that mortgage lenders that participate in the FHA insurance program follow the rules and requirements set forth by HUD,” said Principal Deputy Assistant Attorney General Benjamin C. Mizer.

“Freedom Mortgage did not properly comply with FHA rules for the mortgages it was generating and did not adequately monitor early payment defaults,” added U.S. Attorney Paul J. Fishman for the District of New Jersey.

Between 2006 and 2011, Freedom Mortgage failed to report even a single improperly originated loan to HUD. In 2012, after identifying hundreds of loans that should have been self-reported, the company reported only one .

3. The Overlooked Victims — Veterans and Communities of Color

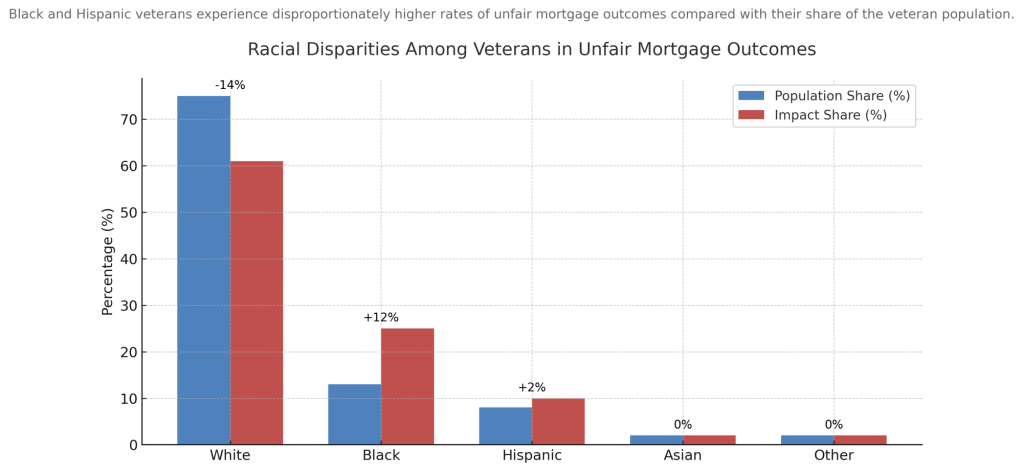

Black and Hispanic veterans experience disproportionately higher rates of unfair mortgage outcomes compared with their share of the veteran population.

Racial Disparities Among Veterans

The data demonstrate that Black and Hispanic veterans are overrepresented among those facing loan denials, foreclosure actions, or rejected assumptions. White veterans — who make up the majority of the veteran population — experience fewer adverse outcomes proportionally.

This imbalance highlights the intersection between race, policy, and practice in the VA and FHA home-loan systems.

4. What VA and FHA Circulars Reveal

VA Circular 26-20-10 (March 27 2020) suspended foreclosures and established guidance for forbearance and credit protections during the COVID-19 pandemic, emphasizing that veterans should not face adverse actions due to hardship.

VA Circular 26-24-13 (August 23 2024) reaffirmed that servicers and lenders must process loan assumptions fairly and cannot impose redundant creditworthiness reviews on existing borrowers seeking to assume their own loans.

Freedom Mortgage’s conduct — as documented by the DOJ — runs contrary to both the spirit and the substance of these directives .

5. Historical Context — A Pattern of Inequity

The racial disparities seen in VA and FHA lending practices are rooted in a long history of housing discrimination — from redlining to inequitable enforcement of underwriting standards.

According to the Urban Institute (2024) and the CFPB (2023 Fair Lending Report), Black and Latino applicants are denied mortgage loans at nearly twice the rate of white applicants, even when controlling for income and credit history. HUD’s 2023 data further confirm that minority borrowers face greater barriers to refinancing, loan modifications, and assumption approvals.

6. Accountability, Reform, and The Let Freedom Ring Amendment

The Freedom Mortgage case exemplifies the urgent need for structural reform in how federally-backed loans are managed.

The Let Freedom Ring Amendment proposes stronger borrower protections, enhanced transparency for loan assumptions, and mandatory accountability mechanisms for servicers who violate federal directives — ensuring that no veteran or borrower of color is denied fairness under programs meant to protect them.

7. References

U.S. Department of Justice (2016, April 15). Freedom Mortgage Corporation Agrees to Pay $113 Million to Resolve Alleged False Claims Act Liability Arising from FHA-Insured Mortgage Lending. justice.gov

U.S. Department of Veterans Affairs (2020, March 27). VA Circular 26-20-10: Suspension of Foreclosures and Guidance for COVID-19 Relief. benefits.va.gov

U.S. Department of Veterans Affairs (2024, August 23). VA Circular 26-24-13: Updated Guidance on Assumptions and Creditworthiness Reviews. benefits.va.gov

Consumer Financial Protection Bureau (2023). Fair Lending Annual Report to Congress. consumerfinance.gov

Urban Institute, Housing Finance Policy Center (2024). Racial Disparities in Mortgage Lending and Access to Credit. urban.org

U.S. Department of Housing and Urban Development (2023). Office of Housing Equity Data Summary. hud.gov.

Leave a comment